Our Fortitude Financial Group Ideas

Our Fortitude Financial Group Ideas

Blog Article

Fortitude Financial Group - Questions

Table of ContentsMore About Fortitude Financial GroupFortitude Financial Group - TruthsThe Of Fortitude Financial GroupUnknown Facts About Fortitude Financial Group7 Easy Facts About Fortitude Financial Group Shown

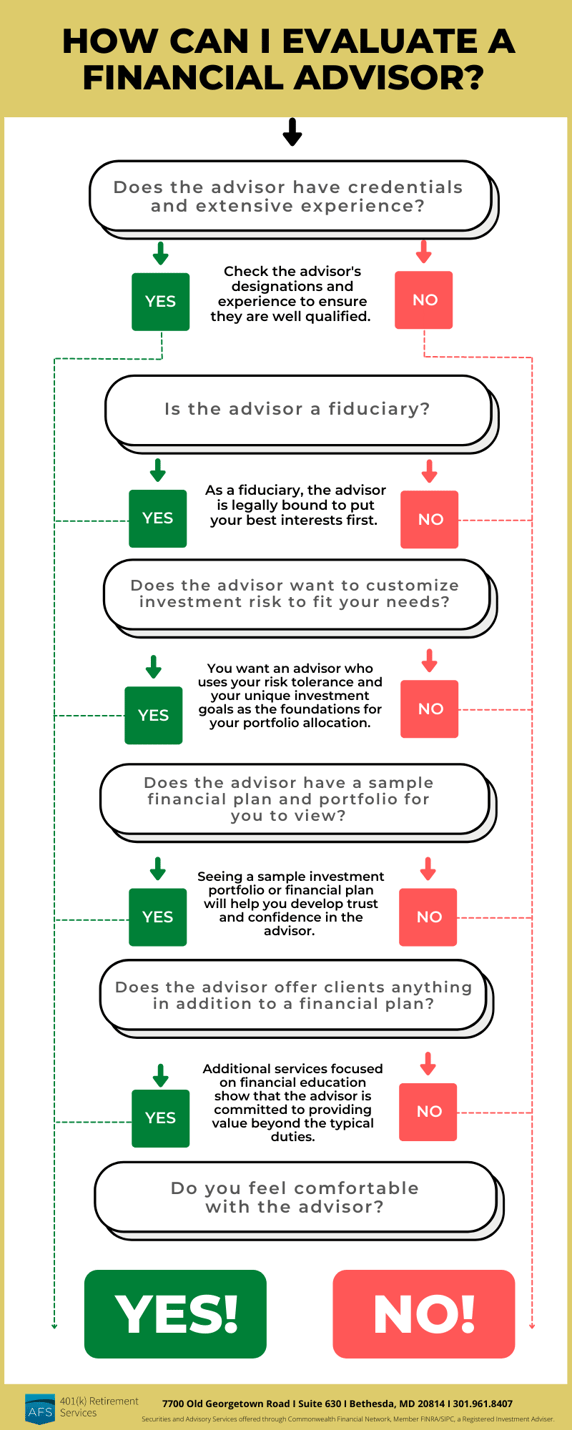

Costs will likewise vary by location and the expert's experience. Some experts might offer lower prices to help customers who are just beginning with economic planning and can not manage a high month-to-month rate. Normally, a monetary consultant will certainly supply a totally free, first consultation. This consultation offers an opportunity for both the customer and the expert to see if they're an excellent suitable for each other.A fee-based expert might earn a charge for developing a financial plan for you, while additionally earning a payment for selling you a specific insurance policy product or investment. A fee-only monetary consultant makes no payments.

Robo-advisors do not require you to have much money to get going, and they set you back less than human monetary experts. Instances consist of Improvement and Wealthfront. These services can conserve you time and potentially cash too. A robo-advisor can't speak with you concerning the finest means to obtain out of financial debt or fund your child's education.

Fascination About Fortitude Financial Group

Robo-advisors generally invest clients' cash in a profile of exchange-traded funds (ETFs) and common funds that offer supply and bond exposure and track a market index. It's additionally important to maintain in mind that if you have a complicated estate or tax problem, you will likely need the very individualized advice that only a human can provide.

An expert can help you find out your financial savings, exactly how to construct for retirement, help with estate planning, and others. If nonetheless you only need to go over profile allocations, they can do that as well (normally for a cost). Financial experts can be paid in a variety of methods. Some will certainly be commission-based and will certainly make a percent of the products they steer you into.

Many monetary experts help a percent cost based upon the amount they are liable for. Some, like hedge funds, will make a percentage of your earnings. Financial consultants are practically never ever "totally free." Despite the fact that you may not be in charge of any ahead of time charges, a monetary advisor can make a percentage of your principal, commissions on what items they market you, and in some cases even a percent of your profits.

This isn't to say the person utilizing the consultant is shedding anything, however the advisor, and that they work, for will constantly discover a way to revenue. Not all financial experts have the exact same degree of training or will certainly provide you the very same depth of solutions. So when acquiring with an expert, do your own due persistance to see to it the expert can meet your financial planning demands.

The Greatest Guide To Fortitude Financial Group

Ramsey Solutions is not connected with any kind of SmartVestor Pros and neither Ramsey Solutions neither any one of its representatives are accredited to supply investment recommendations in behalf of a SmartVestor Pro or to represent or bind a SmartVestor Pro. Each SmartVestor Pro has become part of an arrangement with Ramsey Solutions under which the Pro pays Ramsey Solutions a mix of charges.

The visibility of these plans might influence a SmartVestor Pro's desire to work out below their conventional financial investment advisory costs, and consequently might influence the general fees paid by customers introduced by Ramsey Solutions through the SmartVestor program. Please ask your SmartVestor Pro for more details about their costs (St. Petersburg Investment Tax Planning Service). Neither Ramsey Solutions nor its associates are taken part in providing investment advice

Ramsey Solutions does not necessitate any type of solutions of any SmartVestor Pro about his and makes no claim or assurance of any outcome or success of retaining a SmartVestor Pro - https://hearthis.at/fortitudefg-iq/set/fortitude-financial-group/. Your use the SmartVestor program, including the choice to keep the services of any SmartVestor Pro, goes to your single discretion and threat

The Fortitude Financial Group PDFs

The get in touch with connects provided connect to third-party sites. Ramsey Solutions and its associates are exempt for the accuracy or reliability of any info had on third-party websites.

No 2 individuals will certainly have fairly the same set of financial investment techniques or remedies. Relying on your objectives along with your tolerance for danger and the moment you need to go after those objectives, your expert can help you identify a mix of investments that are appropriate for you and designed to assist you reach them.

An expert can walk you via many intricate economic selections. What happens if you acquire your moms and dads' home? Is it smarter to offer it and invest the earnings or rent it out for income? As you come close to retirement, you'll be confronted with crucial decisions about how long to work, when to claim Social Safety, what order to withdraw money from your different accounts and exactly how to balance your demand for revenue with seeing to it your money lasts you for the rest of your life.

Somebody that can assist them understand all of it. "Your advisor is best made use of as a partner who has the experience to assist you browse the opportunities and challenges of your economic life. The monetary approach your consultant will assist you create resembles an individual financial roadway map you can comply with and adapt to seek your objectives," states Galinskaya.

See This Report on Fortitude Financial Group

Report this page